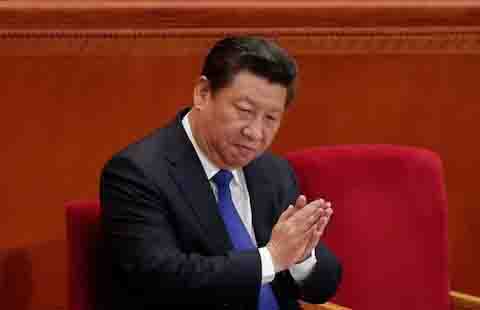

New Delhi. China's economy is not picking up despite the efforts of the Xi Jinping government. In the period from July to September, China's economy grew at a rate of 4.6% on an annual basis. This growth rate is the lowest in the last 18 months. According to Beijing's National Bureau of Statistics (NBS), this is slightly lower than the rate of 4.7% in the last three months and is the slowest growth since the beginning of 2023. Weak consumer spending and sluggishness in the property sector have become the biggest obstacles to China's economic growth.

Weak growth has raised the possibility of a drop in consumer prices, further deepening the country's inflation crisis. The September Consumer Price Index (CPI) also did not perform as expected, pointing to slow demand. In recent weeks, officials have taken several steps to revive the economy, including cutting interest rates and easing restrictions on home purchases. However, investors are still waiting for a large fiscal stimulus package from Beijing.

Confidence in achieving a 5 percent growth rate

According to a report by news agency Reuters, Beijing is confident of achieving its target of 5 percent annual growth. Bruce Peng, chief economist at JLL, said, "China's Q3 2024 figures are not unexpected. Given the weakness in domestic demand, the struggling housing sector,re-energize, and slow export growth, this performance is in line with market expectations." Regarding the stimulus package announced in late September, he said, “This package will take time and patience over the next few quarters to accelerate growth.”

Economists believe that more direct economic stimulus

is needed to re-energize activities and restore business confidence. China's property sector has been a major contributor to the country's economic growth. But now this sector is drowned in debt. China recently announced that more than US$500 billion will be released for unfinished housing projects. The government has also made a plan to renovate 1 million houses.

Desk

Desk Share

Share