Mumbai, February 27, 2025 – The Indian stock market ended flat on Thursday, as gains in banking and NBFC stocks were offset by a decline in auto stocks.

- Sensex closed 10 points higher at 74,612

- Nifty slipped 2 points to 22,545

This marks Nifty’s seventh consecutive session of decline, as investors remained cautious amid foreign fund outflows, weak global cues, and derivative expiry pressures.

Market Movers: Key Gainers & Losers

Top Gainers

NBFCs & Select Banks: Benefited from RBI’s rollback of risk-weight hikes

- AU Small Finance Bank, RBL Bank, L&T Finance, Shriram Finance, Chola Finance (Up 3-6%)

SRF: Gained 3% after a positive demand outlook

Select Midcaps: GNFC, PVR, Varun Beverages, IEX, Bata, Amara Raja ended higher

Top Losers

Auto Stocks: Declined ahead of monthly sales data, dragging the sector down 2%

UltraTech Cement’s Entry into Cables & Wires: Hit Polycab, Finolex Cables, KEI Industries, and Havells, causing up to 21% losses

Prestige Estates: Dropped 5% amid tax department searches

Technical Market Outlook

Rupak De, Senior Technical Analyst, LKP Securities, said:

“Nifty remained range-bound and sellers dominated at higher levels. If Nifty breaks below 22,500, we could see a decline towards 22,200. On the upside, 22,650 is immediate resistance.”

Why is the Market Under Pressure?

Foreign Portfolio Investors (FPIs) Have Sold ₹3.11 Lakh Crore Since October 2024

Weak corporate earnings in Q3 FY25 failed to justify premium valuations

China’s economic recovery attracting global investments

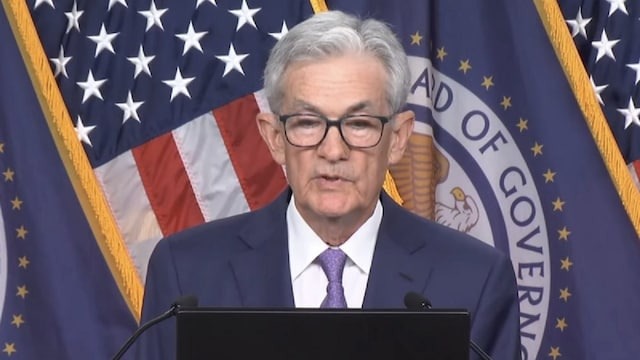

US trade policy concerns & Federal Reserve’s decision to pause rate cuts

What’s Next for Investors?

- Nifty’s resistance at 22,750-22,800 could keep it in a “sell on rise” mode

- Market may remain volatile as investors track global cues, US policy changes, and FPI trends

- Brokerage firms lower Nifty targets, suggesting short-term downside risks

Desk

Desk Share

Share