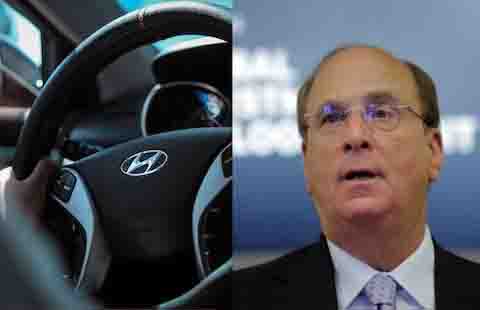

New Delhi. Hyundai India Motor is soon going to launch the country's biggest IPO so far. This IPO will open for anchor investors on October 14, while general investors will be able to bid from October 15. Through this IPO, the company aims to raise more than Rs 25,000 crore, and it will be completely an Offer for Sale (OFS). This IPO is also very enthusiastic among special investors. Big institutions like BlackRock Inc., GIC Singapore, and Capital Group are also showing interest in it.

Led by BlackRock CEO Larry Fink, this company is considered the world's largest asset management company, which manages assets worth more than $ 10 trillion. This is two and a half times India's GDP and has a huge influence on the global stock market. According to reports, apart from BlackRock and GIC, many other domestic and foreign institutional investors are planning to participate in this IPO.

This offer of Hyundai India is for a 17.5% stake i.e. the company will sell 142.2 million shares, due to which the total value of the company is estimated to be around $19 billion. The price band of this IPO has been fixed between Rs 1,865 and Rs 1,960. However, there is no enthusiasm about it in the grey market. According to experts, its grey market premium has fallen by more than 50% recently.

This move by Hyundai is a major effort for the company to strengthen its market share and presence in India. The funds raised through this IPO will help the company to expand and take its operations in a new direction. Along with this, it can also prove to be an attractive opportunity for investors, especially those who wish to invest in the automotive sector.

Desk

Desk Share

Share