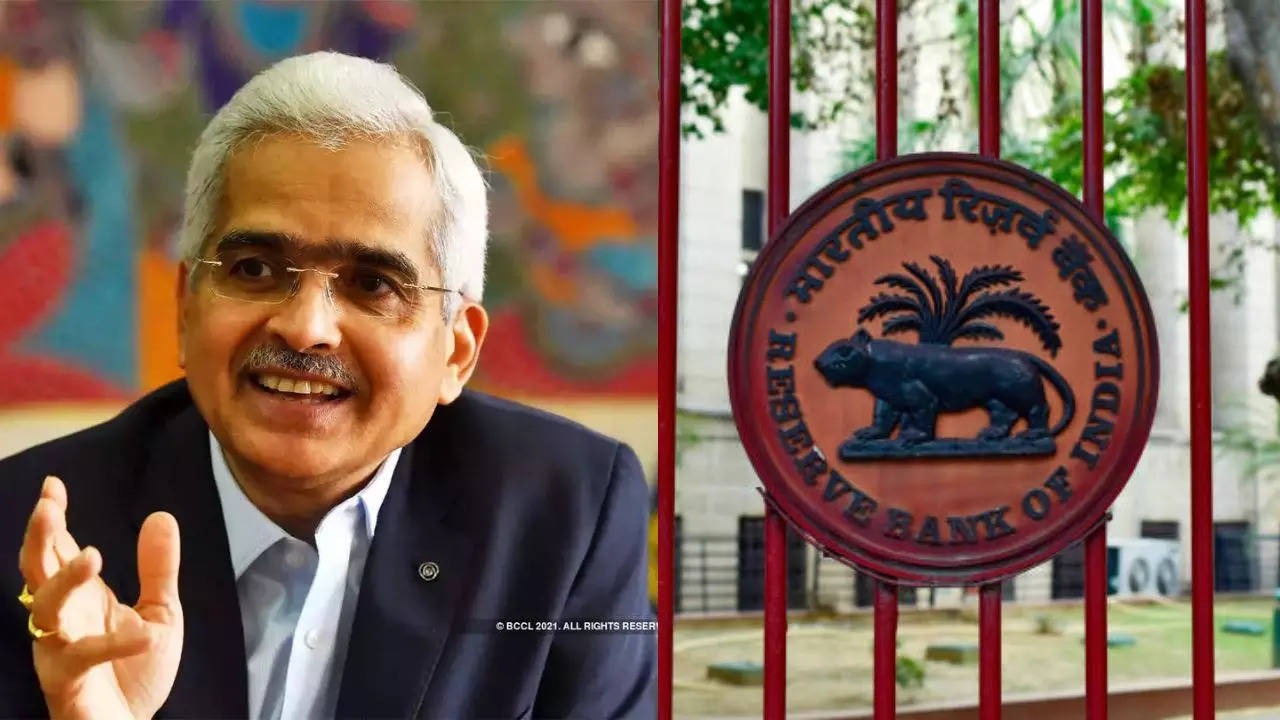

RBI Monetary Policy August 2024: The Reserve Bank of India ( RBI ) has retained the repo rate at 6.5 percent in its August monetary review meeting. There has been no change in the repo rate for the 9th consecutive day. Looking at the global and domestic factors, it was expected that RBI would not change the repo rate this time too. Not reducing the repo rate will not make the loan cheaper, due to which your EMI will not decrease. However, EMI will not increase due to the loan not becoming expensive. RBI Governor Shaktikanta Das said that the share of food inflation is 46% of the main inflation, and it cannot be ignored. He clarified that RBI's focus will remain on inflation. 4 out of 6 members of the RBI Monetary Policy Committee decided in favor of not changing the repo rate.

Reverse repo rate and bank rate retained at current levels

According to the RBI Governor, price stability is important for sustainable growth. In today's meeting, MSF (Marginal Standing Facility), reverse repo rate, and bank rate have also been kept at the current levels.

At present, MSF is 6.75%, reverse repo rate is 3.35 percent and bank rate is 6.75 percent. According to Shaktikanta Das, RBI is trying to bring the inflation rate to the target of 4 percent. The current global growth outlook looks positive, but there are challenges for global growth in the mid-term.

what is the repo rate

Repo is the interest rate at which commercial banks borrow money from the central bank to meet their financial needs. RBI uses it to control inflation. Keeping the repo rate at 6.5 percent means that there is very little chance of change in the monthly installment (EMI) on all loans including home and auto.

What is the GDP and inflation estimate?

Das said that the central bank has retained the GDP (gross domestic product) growth forecast for 2024-25 at 7.2 percent. At the same time, the forecast of retail inflation to be 4.5 percent in the current financial year has also been retained.

There will be no change in the repo rate for the fourth consecutive time in 2024

According to Ashwani Rana, founder of Voice of Banking, no change has been made in the repo rate even in the Reserve Bank meeting. For the fourth consecutive time in 2024, the Reserve Bank has not changed the repo rate. The Reserve Bank is making efforts to control inflation but the inflation rate is still above the Reserve Bank's target. Right now the repo rate will remain at 6.50.

Bank customers waiting for a reduction in the repo rate have been disappointed. If the Reserve Bank feels that inflation has come under control, it can cut the repo rate in its next meeting. Amid a good monsoon, the Reserve Bank can make some positive decisions in the upcoming meeting.

Desk

Desk Share

Share

_939839210.jpg)