_492240665.jpg)

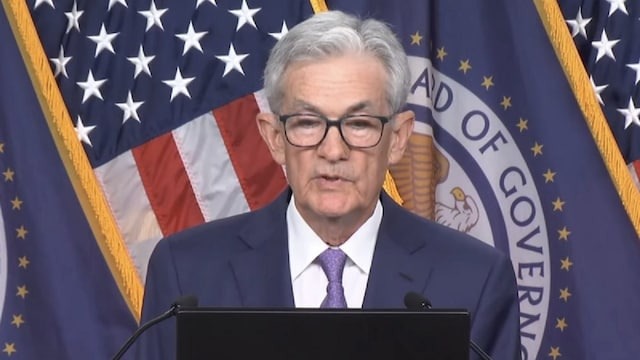

FPI Investment: Foreign portfolio investors (FPIs) have sold Indian shares heavily in the last two months. Now FPIs have regained their confidence in the Indian stock market. In fact, FPIs made a net investment of Rs 24,454 crore in shares in the first week of December. According to experts, this happened due to stability in the global situation and the possibility of interest rate cuts by the US Federal Reserve. Earlier, FPIs had made huge withdrawals of Rs 21,612 crore in November and Rs 94,017 crore in October.

FPI investment reached Rs 9,435 crore

It is worth noting that in September, FPI buying was at a 9-month high, when a net investment of Rs 57,724 crore was made. Depository data showed that with the fresh flow, FPI investment in 2024 so far has reached Rs 9,435 crore.

What will happen next?

Himanshu Srivastava, joint director of Morningstar Investment Research India, said that in the coming months, the attitude of FPIs will be determined by the policies implemented under Donald Trump's presidency, inflation, interest rates, and geo-political scenario. He said that apart from this, the third-quarter earnings performance of Indian companies and the country's progress on the economic growth front will play an important role in shaping investor sentiment and influencing the foreign investment.

Uncertainty on Chinese equities due to proposed tariffs

Srivastava further said that the recent correction in the market may have prompted FPIs to increase some investments. Apart from this, uncertainty on Chinese equities due to proposed tariffs by Donald Trump on China and many other countries may also have led FPIs to turn towards Indian equities again.

Desk

Desk Share

Share