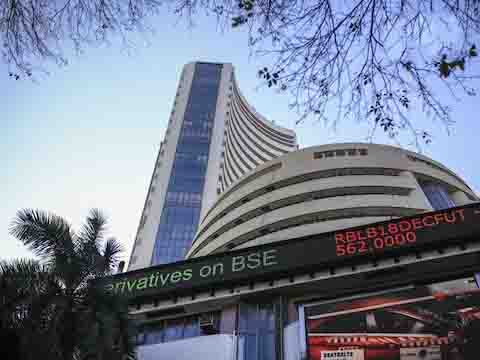

New Delhi. Foreign portfolio investors investing in the Indian market is often an indication that the market will go up for some time. But their exit also indicates the opposite. Investors have seen this happen in the last few months. The overall market gave decent returns in the new year but there is no need to be very happy with it. In fact, foreign investors still seem to be upset with the Indian market. Foreign portfolio investors (FPIs) have started 2025 with caution in the Indian stock markets.

According to data from the National Securities Depository Limited (NSDL), FPIs have sold Indian stocks net Rs 4,285 crore in the first three trading days of the year. Notably, on the first day of 2025, there was a net sell-off of Rs 5,351 crore, which was the biggest single-day sell-off this year.

Last year, FPI made us cry a lot.

Data for December 2024 shows that net investment of FPI remained positive in Indian stock markets, where ₹15,446 crore was invested. However, a huge decline in FPI investment was seen in 2024. FPI investment declined by 99% on an annual basis. The main reason for this was the dominance of the US economy in the global markets and other domestic challenges.

The main reasons behind FPI selling are

the dominance of the US market and the challenges of the Indian market. The strength of the US economy, the better performance of the stock market and high interest rates attracted investors towards US bonds and equities. At the same time, high valuations in the Indian market, high market cap-to-GDP ratio, slow GDP growth, weak industrial production and declining corporate profits affected FPIs.

Desk

Desk Share

Share